The Definitive Guide for Ach Payment Solution

The RDFI uploads the return ACH file to the ACH network, along with a reason code for the error. ACH payments can serve as a terrific choice for Saa, S organizations.

With ACH, considering that the deal processing is repeating as well as automatic, you would not need to wait for a paper check to show up. Likewise, because customers have actually authorized you to accumulate settlements on their behalf, the adaptability of it enables you to gather one-time repayments as well. No much more uncomfortable e-mails asking clients to pay up.

Bank card payments fall short due to numerous reasons such as expired cards, blocked cards, transactional mistakes, and so on. In some cases the customer can have exceeded the credit line which can have caused a decline. In case of a financial institution transfer using ACH, the bank account number is used in addition to a permission, to charge the client and unlike card transactions, the chance of a financial institution transfer failing is really reduced.

Our Ach Payment Solution Diaries

Unlike card transactions, bank transfers stop working only for a handful of reasons such as not enough funds, incorrect financial institution account information, and so on. The two-level verification procedure for ACH settlements, guarantees that you maintain a touchpoint with consumers.

This safe and secure process makes ACH a trustworthy alternative. For each credit rating card transaction, a percent of the cash entailed is divided across the numerous entities which allowed the payment.

and is typically as much as 2% of the overall purchase charge. Yet in case of a deal routed via the ACH network, considering that it directly takes care of the banking network, the interchange charge is around 0. 5-1 % of the total deal. Below's some quick math with some basic percent prices to make points easier: Let's claim you have an enterprise customer that pays you a yearly subscription charge of $10,000.

Some Ideas on Ach Payment Solution You Should Know

For a $10,000 transaction, you will pay (0. The fee for a typical ACH purchase varies somewhere around 0. The actual TDR (Purchase Discount Price) for ACH differs according to the repayment gateway used.

Smaller sized transfer costs (typically around $0. 2% per deal)Repayments are not automated, Automated repayments, Take even more time, Take much less time, Refine intensive and also therefore not as very easy to make use of, Easy to use, ACH costs less and is of wonderful value to vendors however the difficulty is obtaining a big number of customers onboard with ACH.

Freelancing system Upwork has actually made use of intriguing techniques to drive ACH adoption. They bill 3% more on the debt card deals. Additionally, they charge high quantity More Help (greater than $1000) customers with just $30 level cost for endless ACH deals. You can drive boosted adoption of ACH repayments over the long-term by incentivizing consumers making use of benefits and also rewards.

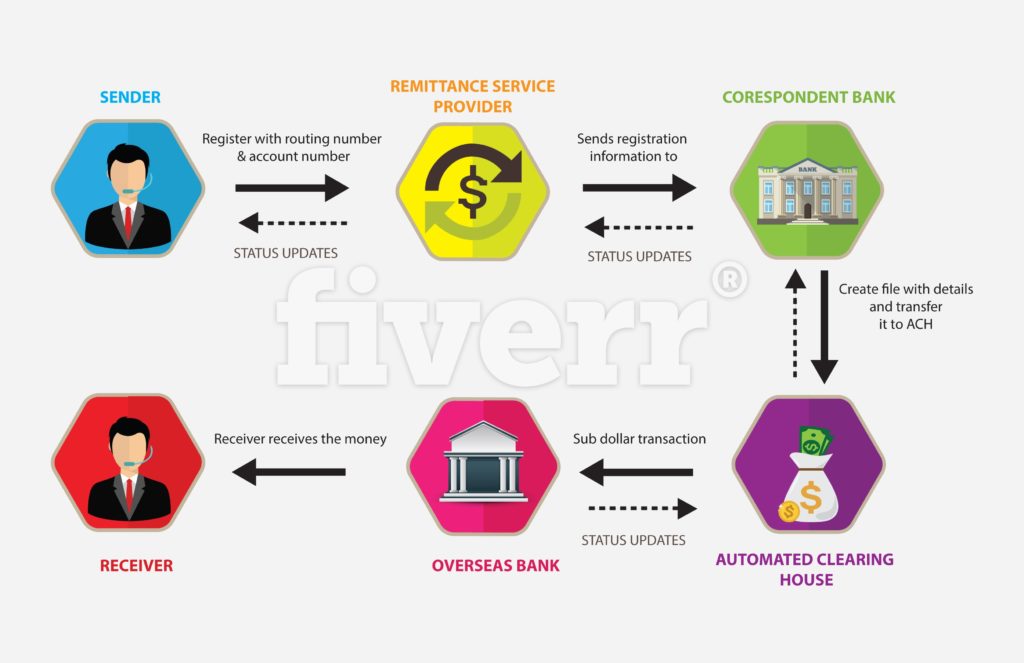

ACH transfers are digital, bank-to-bank cash transfers refined through the Automated Clearing Up House (ACH) Network. According to Nacha, the organization in charge of these transfers, the ACH network is a batch handling system that banks and various other financial institutions usage to accumulation these transactions for processing. ACH transfers are electronic, bank-to-bank cash transfers refined through the Automated Clearing Up Home Network.

5 Easy Facts About Ach Payment Solution Explained

Direct repayments entail cash going out you could try these out of an account, consisting of costs payments or when you send cash to someone else. ach payment solution. ACH transfers are convenient, quick, and usually complimentary. You might be restricted in the number of ACH transactions you can launch, you may incur extra fees, as well as there might be delays in sending/receiving funds.

Getting your pay via direct down payment or paying your bills online with your checking account are just 2 examples of ACH transfers. You can likewise make use of ACH transfers to make solitary or recurring deposits into an individual retired life account (IRA), a taxable brokerage firm account, or a university interest-bearing account. Local business owner can likewise utilize ACH to pay vendors or get repayments from clients as well as clients.

Nacha reported that there were 29 billion settlements in 2021. That's a rise my sources of 8. 7% from the previous year. Person-to-person and also business-to-business deals also enhanced to 271 million (+24. 9%) as well as 5. 3 billion (+21%), respectively, for the very same duration. ACH transfers have lots of usages and also can be a lot more cost-efficient and straightforward than writing checks or paying with a credit history or debit card.